4 ways to Invest in Real Estate

Whether you are new to investing or a seasoned investor, real estate is a form of investing worth considering. There's more than one way to invest in the real estate market and generate a significant income.

Here, we take a look at four ways to invest in real estate.

1. Buying Rental Property

You can create additional income by buying a home and renting it out. To get a make a return on your investment, the rent you charge for the property must exceed the total of the monthly payments on the home, including mortgage payments, property tax, and home insurance.

Improve your monthly profit by buying property in a high-rent area or make a higher than required down payment to bring down the monthly mortgage payment. Visit online property listings to identify lucrative rental properties.

The downsides to directly owning a property are the down payment and tenant management. You typically need to make a sizable upfront payment to buy the property. The maintenance costs of rental properties can also add up very quickly. Before buying a home, determine whether the monthly profit is worth the investment.

Dealing with tenants is a huge part of managing your rental property. You can either do it yourself or hire a good property management services, which adds to your total cost.

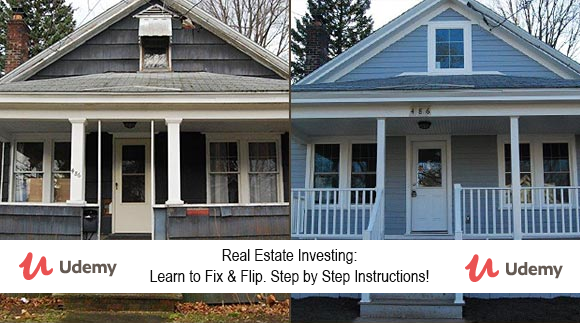

2. Flipping Houses

This form of real estate investment is best suited for people with experience in marketing and real estate valuation. In addition to substantial capital, you need to be proficient in overseeing home repairs or doing them yourself.

The capital of a real estate investor is held up in the property for a shorter period than that of one who buys homes to rent. Depending on the market conditions, you can make huge profits in an extremely short time frame.

On the downside, to succeed in flipping real estate properties, you need deeper market knowledge and more extensive experience than investors who buy property to rent. A seemingly hot market can suddenly go cold, leaving you with considerable losses.

Many investors consider flipping the wild side of real estate. The comparison of flippers to landlords is analogous to that of day traders and long-term stock traders. Both flippers and day traders aim to identify undervalued assets and sell them once the market corrects the price.

3. Real Estate Investment Groups

If you want to generate income from a rental property without the hassle of managing it, real estate investment groups may be the best option for you. To get in, you access to financing and a capital cushion.

This form of real estate investing lets a real estate investor take a more hands-off approach to managing your investment while you still benefit from income and asset appreciation. However, real estate investment groups present a vacancy risk, be it owner-specific or spread across the group. Moreover, the management overhead can erode returns.

Real estate investment groups operate like small mutual funds that manage investments in rental properties. The company builds or buys a set of condos or apartment blocks, then lets investors buy these properties through the company—effectively joining the group.

Investors can own one or more units of the property while the company that runs the investment group manages all the units. It interviews the runs ads, interviews the tenants and handles the maintenance. The company takes a share of the monthly rent in exchange for managing the property.

4. Real Estate Investment Trusts (REITs)

REITs let you add real estate to your investment portfolio without having to go through the traditional real estate transactions. All you need is investment capital. In essence, REITs are dividend-earning stocks for which the core holdings are commercial real estate properties with long-term leases. For that reason, keep in mind that REITs don't offer the leverage associated with traditional real estate investments.

A corporation creates a REIT when it uses investors' money to buy and manage income properties. You can buy and trade REITs on major exchanges—just like company stocks. Corporations maintain their REIT status by paying out 90% of their taxable profits in dividends. Doing so lets them avoid the corporate income tax that regular companies pay.

REITs are a good way to generate a solid income stream similar to that from dividend-paying stocks. They also let you invest in office buildings and malls, properties that aren't ordinarily available to individual investors.